Low-mintage coins are a fascinating aspect of numismatics that can add significant value to a collection.

Low-mintage coins have a limited number of pieces produced, making them scarce and highly sought after by collectors. The lower the mintage, the rarer the coin, and the higher its potential value.

Key Takeaways

1. Low-mintage coins are rare and highly sought after by collectors.

2. Factors that influence mintage include the year of production, quality of proof, and surface design.

3. Low-mintage coins can offer potential benefits, such as increased value, but may also have drawbacks, such as difficulty finding and purchasing them.

What Does Low Mintage Mean on a Coin?

Mintage is a term used to describe the number of coins a mint produces. It is an important factor in determining the rarity and value of a coin. The lower the mintage, the rarer the coin and the more valuable it is likely to be.

Mintage numbers can vary greatly depending on the type of coin and the year it was produced.

For example, some modern coins may have a mintage in the millions, while older coins may have a mintage in the thousands or even hundreds.

It is important to note that mintage does not necessarily correspond to the number of still-existing coins. Coins can be lost, destroyed, or melted down, increasing a particular coin’s rarity and value.

Coin collectors often seek out coins with low mintage as they are considered more valuable and desirable.

However, it is important to remember that other factors, such as condition, rarity, and historical significance, also play a role in determining a coin’s value.

In addition to its impact on a coin’s value, mintage can provide insight into its history and production. By examining mintage numbers over time, one can better understand the changing demands and priorities of the minting process.

Low Mintage Coins

Low-mintage coins have a limited number of pieces produced by the mint. The mintage number of a coin refers to how many coins were struck by the mint. It does not, however, necessarily refer to how many coins still exist.

The scarcity of a coin is an essential factor in determining its value. Generally, a lower mintage boosts the performance potential of a coin because it increases its rarity. Nonetheless, several factors, such as the date of production, quality of proof, and surface design, help numismatists determine the scarcity of a piece.

For instance, the Lincoln Cent is one of the longest-running pieces of currency in U.S. history. Therefore, the mintage number of a Lincoln penny produced in the 1900s would be higher than that of a modern Lincoln penny.

A million coins minted in the 1820s would be considered a high mintage for early half cents, but for the modern Lincoln cent, under 100 million is considered low.

Factors Influencing Mintage

Mintage refers to the number of coins a mint produces during a particular year or period. The mintage of a coin is influenced by several factors, including:

- Demand: If the demand for a particular coin is high, the mint may produce more coins to meet the demand. Conversely, the mint may produce fewer coins if the demand is low.

- Availability of metals: The availability of metals used to produce coins can also influence mintage. If the supply of metals is limited, the mint may produce fewer coins.

- Technology: Advancements in technology can also influence mintage. For example, using automated presses can increase the production of coins.

- Economic conditions: Economic conditions can also influence mintage. In times of economic stability, the mint may produce more coins. In times of economic uncertainty, the mint may produce fewer coins.

- Legislation: Legislation can also influence mintage. For example, the Coinage Act of 1965 led to the removal of silver from circulating coins, which affected the mintage of silver coins.

It is important to note that the mintage of a coin does not necessarily determine its value. Other factors, such as the rarity, condition, and historical significance of the coin, can also influence its value.

Benefits of Low Mintage Coins

Low-mintage coins were produced in limited quantities, making them relatively rare and valuable. There are several benefits to owning low-mintage coins, including scarcity value and investment potential.

1. Scarcity Value

Low-mintage coins have scarce value, meaning they are rare and hard to find. This scarcity value makes them more valuable to collectors and investors. The lower the mintage, the higher the scarcity value, which can translate into higher prices.

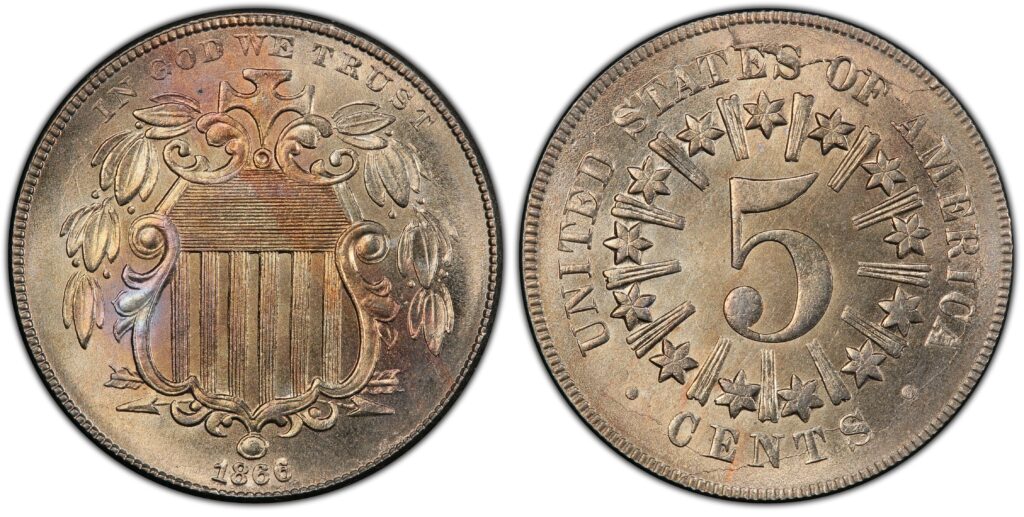

For example, the 1866 and 1867 Shield Nickel had mintages of only 14,742 and 28,890, respectively. Collectors highly seek these coins due to their low mintage and scarcity value.

As a result, they can be worth thousands of dollars, even in lower grades.

2. Investment Potential

Investors can purchase low-mintage coins to diversify their portfolios and hedge against inflation. Low-mintage coins can also be a good long-term investment, as their rarity and historical significance can increase their value over time.

In conclusion, owning low-mintage coins can provide several benefits, including scarcity value and investment potential. However, investors should carefully consider their options and research before investing in coins.

Drawbacks of Low Mintage Coins

Low-mintage coins are often considered rare and valuable by collectors. However, there are some drawbacks to owning low-mintage coins that collectors should be aware of. This section will discuss two major drawbacks of low-mintage coins: market variability and liquidity issues.

1. Market Variability

One of the major drawbacks of low-mintage coins is the variability of the market. Low-mintage coins are often subject to sudden price fluctuations due to changes in demand.

For example, if a low-mintage coin suddenly becomes popular among collectors, the price of the coin may skyrocket. Conversely, if the demand for the coin drops, the price may plummet.

This variability can make it difficult for collectors to predict the future value of their low-mintage coins. It is important to remember that just because a coin has a low mintage does not necessarily mean it will increase in value over time.

2. Liquidity Issues

Low-mintage coins can be difficult to sell in the secondary market, especially if there is a lack of demand. This can make it difficult for collectors to liquidate their holdings if they need to raise cash quickly.

Additionally, low-mintage coins may be difficult to authenticate, further complicating the selling process. Collectors should be prepared to hold onto their low-mintage coins for an extended period if they cannot find a buyer in the short term.

Identifying Low-Mintage Coins

Here are some ways to identify low mintage coins:

- Check the Mintage Numbers

- To identify low-mintage coins, collectors and investors should check the mintage numbers for the specific coin they are interested in.

- Generally, coins with mintage numbers below 1 million are considered low mintage.

- Look for Key Dates

- Key dates are coins that were produced in limited quantities due to various reasons such as errors, design changes, or historical significance.

- Collectors and investors highly seek these coins, often commanding a premium price.

- To identify key date coins, collectors and investors should research the coin’s history and look for years with low mintage numbers.

- Consider the Condition

- The condition of a coin can also impact its rarity and value. Low-mintage coins in excellent condition are even rarer and can command a higher price. Collectors and investors should consider the coin’s condition when identifying low-mintage coins.

- Seek Expert Advice

- Identifying low-mintage coins can be challenging, especially for beginners. Collectors and investors should seek expert advice from reputable coin dealers or numismatists who can help identify rare coins and provide guidance on their value and investment potential.

Identifying low-mintage coins requires research, knowledge, and experience. Collectors and investors should take the time to learn about the coin’s history, check the mintage numbers, consider the condition, and seek expert advice to make informed decisions when adding rare coins to their collection or portfolio.

Before you go…

Low-mintage coins can be valuable to any coin collection, but collectors should approach them carefully.

Check out my next article: “What is a Memorial Reverse Penny?“

Related Articles: